Case studies

Insights

Blog

Solutions

Services

MEDIA BUYING

OOH in Russia. Overview and main trends in 2022

Natali Gorenkova

Share this Post

Like other segments of the advertising market in Russia, in 2022 OOH managed to show considerable growth after the pandemic with further drop and then more or less stabilize its performance by the third quarter. In many ways, such changes are associated with the departure of foreign companies that purchased huge areas of outdoor advertising before March of this year. In spite of that, many experts agreed that OOH is still not as badly affected as, for example, advertising on the Internet. Because a significant proportion of domestic advertisers were and are now present in this segment.

Is it really so? RMAA experts reviewed the situation on the Russian market to figure out what is currently happening with OOH, what main trends in the industry are, as well as to give an approximate forecast of development in the near future

Is it really so? RMAA experts reviewed the situation on the Russian market to figure out what is currently happening with OOH, what main trends in the industry are, as well as to give an approximate forecast of development in the near future

Get the White Paper

Possible Prospects For New Brands

Russian Market Under The Influence Of Western Sanctions

Contact us

Ready to discuss your marketing challenges in emerging markets with our team?

Forecasts and Intermediate Results 2022

According to the commission of experts of the Association of Communication Agencies of Russia (ACAR), the first quarter of 2022 turned out to be profitable for the advertising market as a whole compared to the same period in 2021. The total volume of advertising in various distribution media amounted to 128-130 billion rubles (+5% compared to a year earlier). At the same time, in four media segments - TV, radio, press and OOH - the indicators remained at the same level of the previous year.

If we talk in more detail about out-of-home advertising, its volume began falling down a bit as early as this March. The point is that every year during this period, experts noted a seasonal increase in commercial loading. However, no such “jump" in indicators occurred in 2022. Nevertheless, the share of brands that left Russia turned out to be relatively low in the OOH segment.

Based on this situation and having assessed possible risks of the exit of foreign companies from the Russian market in the future, in April 2022 Adindex specialists assumed that the OOH segment would be reduced by about 5 billion rubles. According to their calculations, it turned out that the share of budgets of all resident brands of unfriendly to Russia countries is 14.84%. Also, probable development scenarios were calculated.

In case of minimal losses, the catering category, where McDonald's (57.05%), You! Restaurants International Russia (32,5%) и Burger King (10,5%) are the main brands, will have the largest impact on the segment as a whole. In the second place was the category of furniture and interior items due to the IKEA brand (1.21% of the total OOH on the market). Then, soft drinks, where Coca-Cola (53.4%) and Pepsi Co (46.6%) are the leaders. With the worst possible outcome of events, the category of construction and finishing materials will also be added to them because of the Leroy Merlin brand (1.64%).

A while later, in May 2022, All-billboards analysts expressed their opinion on the current situation by publishing an annual rating of billboard operators. According to Andrey Baiduzhy, the head of the service (in an interview with Kommersant), out-of-home advertising market, even with the most favorable outcome, will return to falling down again in 2022. It will be tens of percent, as in 2020 in the pandemic time, especially for advertising at airports. Since this segment has not been able to fully recover in 2021 (by 40% compared to 2019). In addition, the volume of OOH in cinemas has already reduced to statistically insignificant.

In turn, advertisers confirmed all the above mentioned conclusions and commented on the current state of the market.

If we talk in more detail about out-of-home advertising, its volume began falling down a bit as early as this March. The point is that every year during this period, experts noted a seasonal increase in commercial loading. However, no such “jump" in indicators occurred in 2022. Nevertheless, the share of brands that left Russia turned out to be relatively low in the OOH segment.

Based on this situation and having assessed possible risks of the exit of foreign companies from the Russian market in the future, in April 2022 Adindex specialists assumed that the OOH segment would be reduced by about 5 billion rubles. According to their calculations, it turned out that the share of budgets of all resident brands of unfriendly to Russia countries is 14.84%. Also, probable development scenarios were calculated.

In case of minimal losses, the catering category, where McDonald's (57.05%), You! Restaurants International Russia (32,5%) и Burger King (10,5%) are the main brands, will have the largest impact on the segment as a whole. In the second place was the category of furniture and interior items due to the IKEA brand (1.21% of the total OOH on the market). Then, soft drinks, where Coca-Cola (53.4%) and Pepsi Co (46.6%) are the leaders. With the worst possible outcome of events, the category of construction and finishing materials will also be added to them because of the Leroy Merlin brand (1.64%).

A while later, in May 2022, All-billboards analysts expressed their opinion on the current situation by publishing an annual rating of billboard operators. According to Andrey Baiduzhy, the head of the service (in an interview with Kommersant), out-of-home advertising market, even with the most favorable outcome, will return to falling down again in 2022. It will be tens of percent, as in 2020 in the pandemic time, especially for advertising at airports. Since this segment has not been able to fully recover in 2021 (by 40% compared to 2019). In addition, the volume of OOH in cinemas has already reduced to statistically insignificant.

In turn, advertisers confirmed all the above mentioned conclusions and commented on the current state of the market.

Source: myTarget, March-August 2022

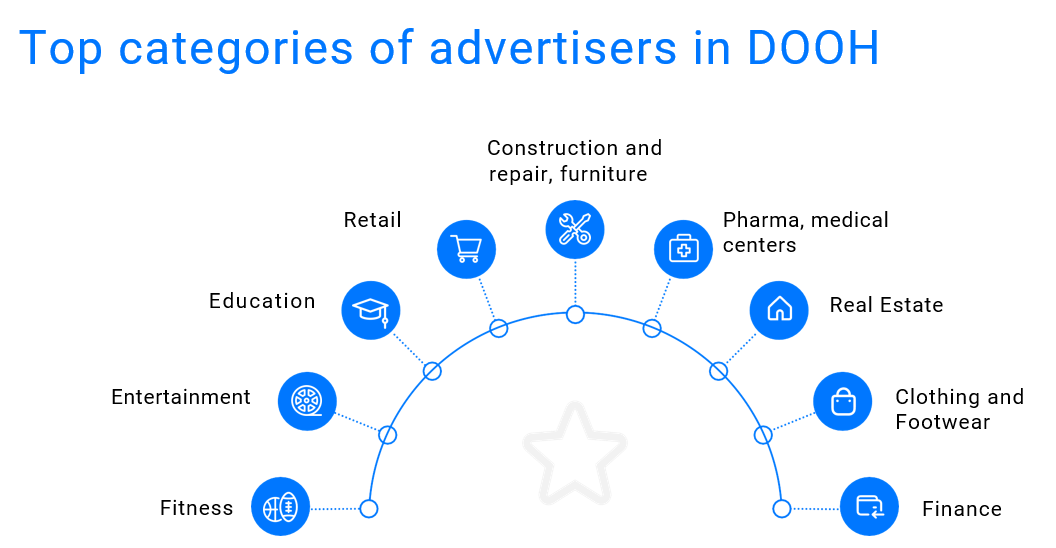

Thus, Gallery representatives (in an interview with Kommersant) clarified that currently foreign advertisers are actively leaving the segment. Moreover, this indicator is equal to 70-80% in some categories. The situation turned out to be ambiguous: against the background of how auto manufacturers are reducing budgets for out-of-home advertising in Russia, real estate developers and banks, on the contrary, are increasing the share of outdoor advertising for their campaigns.

Natalia Valieva, CEO of Sunlight Outdoor, is not sure about the drop in the segment, but at the same time does not deny the fact that the market is currently unstable. What she said in an interview for Adindex: “If we take the absolute budget figures of advertisers from those who announced their departure, then their share in our revenues is 9%, while the share of all foreign advertisers is 20%. However, many Russian advertisers are suffering from the current situation, therefore we expect an outflow of budgets from them as well. It is still extremely difficult to make predictions of a decline for the year, but we can say for sure that those digital surfaces that operators ordered and did not manage to pay will be redeemed at the dollar exchange rate 50% higher than intended in financial plans, which can increase the payback of these projects, coupled with a drop in sales, by almost half."

Konstantin Major, CEO of Maer media holding, also saw both positive and negative sides in the current situation.

“First of all, operators of traditional banner outdoor advertising will suffer: the cost of components and services in this market segment increased significantly, which led to a sharp rise in the cost of advertising contact. Digital outdoor advertising operators have no such problems in principle. They do not bear the costs of purchasing banner fabric and printing services, transportation costs and hiring installers. Therefore, the cost of contact in the digital segment of outdoor advertising remains the same. At present, uncredited DOOH operators can advantageously use a competitive strategy "First in price and coverage". Technological effectiveness and omnichannel of DOOH services will only strengthen the competitive advantage.”

The idea, that in 2022 digital out-of-home advertising will get a significant boost and will be able to keep the indicators in the segment, is supported by All-billboards specialists (in an interview with Kommersant). At least, this placement format has a significant advantage over traditional OOH: it allows you to refuse long-term planning and launch campaigns more quickly due to the absence of long-term printed preparation of materials. According to preliminary forecasts, the share of DOOH will reach 43-45% by the end of 2022 (in 2021 it was already about 40% of the total volume of out-of-home advertising). Since already now many advertisers note a significant “preponderance” of budgets in favor of digital media and the rejection of static designs.

In other words, it is difficult to say that experts' forecasts regarding a significant drop in the OOH segment will come true with 100% certainty in 2022. On the one hand, foreign brand-leaders in the advertising area procurement are really leaving the market. On the other hand, the digital format of the out-of-home advertising, which can significantly “mitigate" the situation, comes to the forefront. Besides, new players in the advertising industry are emerging in Russia to replace the companies that left the market.

Anyway, main trends of 2022 in out-of-home advertising are set by the digital format.

Natalia Valieva, CEO of Sunlight Outdoor, is not sure about the drop in the segment, but at the same time does not deny the fact that the market is currently unstable. What she said in an interview for Adindex: “If we take the absolute budget figures of advertisers from those who announced their departure, then their share in our revenues is 9%, while the share of all foreign advertisers is 20%. However, many Russian advertisers are suffering from the current situation, therefore we expect an outflow of budgets from them as well. It is still extremely difficult to make predictions of a decline for the year, but we can say for sure that those digital surfaces that operators ordered and did not manage to pay will be redeemed at the dollar exchange rate 50% higher than intended in financial plans, which can increase the payback of these projects, coupled with a drop in sales, by almost half."

Konstantin Major, CEO of Maer media holding, also saw both positive and negative sides in the current situation.

“First of all, operators of traditional banner outdoor advertising will suffer: the cost of components and services in this market segment increased significantly, which led to a sharp rise in the cost of advertising contact. Digital outdoor advertising operators have no such problems in principle. They do not bear the costs of purchasing banner fabric and printing services, transportation costs and hiring installers. Therefore, the cost of contact in the digital segment of outdoor advertising remains the same. At present, uncredited DOOH operators can advantageously use a competitive strategy "First in price and coverage". Technological effectiveness and omnichannel of DOOH services will only strengthen the competitive advantage.”

The idea, that in 2022 digital out-of-home advertising will get a significant boost and will be able to keep the indicators in the segment, is supported by All-billboards specialists (in an interview with Kommersant). At least, this placement format has a significant advantage over traditional OOH: it allows you to refuse long-term planning and launch campaigns more quickly due to the absence of long-term printed preparation of materials. According to preliminary forecasts, the share of DOOH will reach 43-45% by the end of 2022 (in 2021 it was already about 40% of the total volume of out-of-home advertising). Since already now many advertisers note a significant “preponderance” of budgets in favor of digital media and the rejection of static designs.

In other words, it is difficult to say that experts' forecasts regarding a significant drop in the OOH segment will come true with 100% certainty in 2022. On the one hand, foreign brand-leaders in the advertising area procurement are really leaving the market. On the other hand, the digital format of the out-of-home advertising, which can significantly “mitigate" the situation, comes to the forefront. Besides, new players in the advertising industry are emerging in Russia to replace the companies that left the market.

Anyway, main trends of 2022 in out-of-home advertising are set by the digital format.

DOOH in Real Practice in Russia

Global popularization of this outdoor advertising format is mainly associated with programmatic technologies that allow you to adapt to any weather conditions and characteristics of the audience. Thanks to this, outdoor advertising has become a full-fledged digital communication tool and has gained flexibility.

According to Gallery estimates the share of DOOH-programmatics in Russia already accounted for about 10% of the revenue of digital outdoor advertising in 2021. Moreover, advertisers, who considered outdoor advertising less than technological in the past, began to look closely at this format. However, this is far from the case now.

DOOH innovations have expanded the possibilities of placing advertisements. In particular, AR, VR, Mixed Reality, gesture motion sensors, Beacon/RFID, mobile retargeting for hypertargeting to pDOOH, IoT, cloud computing and real-time channel integration on digital screens. All these technologies have made it possible to improve the user experience of interacting with outdoor advertising in real time. In 2022, beacons were added to these tools, which allow you to send a signal from an advertising screen via Bluetooth to nearby smartphones. Thanks to this, advertisers can connect to users' phone in order to send them an informational, contextual or personalized experience. Eventually, beacons have increasingly become profitable means for news agencies, shopping malls and transportation services.

In other words, whatever a digital tool is used for a particular advertising screen, its advantages remain indisputable. In any format, DOOH provides advertisers with key data on consumer behavior that can and should be taken into account in further marketing communication in order to improve it. We are talking about data such as ad playback time, location of DOOH installations, total costs, etc.

All these technologies are also actively used on the Russian market, but with a single caveat. On the one hand, DOOH accounts for about 40% of revenue in the segment (the same indicator in the USA). At the same time, the share of digital inventory on the market is only 19%. Its volume has been growing in recent years, according to experts, but not at such a rapid pace. Probably, by the end of 2022, this figure will be considerably higher, since not only in advertisers, who purchased traditional OOH media in the past, are interested in the DOOH format, but also new digital players.

ACAR analysts managed to find out the level of digital technology coverage on the market in 2022. According to the poll, RTB is provided by 55% of regional outdoor advertising operators, 46% use guaranteed sales (guaranteed number of impressions) or OST (frequency of audience contacts with advertising) at a fixed price for a certain time period. Another 46% provide API integrations in which the client plans to place on the operator's advertising surfaces. Among Moscow advertisers of outdoor advertising, only 25% use auction sales, 29% guarantee a fixed number of impressions, while API is 33%. At the same time, the most common technology for collecting and analyzing data turned out to be a Wi-Fi audience tracking system for collecting unique MAC addresses of users. 47% of operators in Moscow, 29% in St. Petersburg and 24% in the regions are ready to provide this option.

In addition, other technologies are available to OOH customers. These include: launching videos by triggers, live broadcasts, setting up targeting and retargeting in real time by interests and socio-demographic characteristics, 3D advertising, dynamic creative management and synchronization of advertising impressions with multiple facades. Plus, operators are ready to provide data on the effectiveness of DOOH due to brand and sales lift, independent pixel meters (Weborama, Sizmek, Adriver) and monitoring of AdMetrix and Mediascope advertising output.

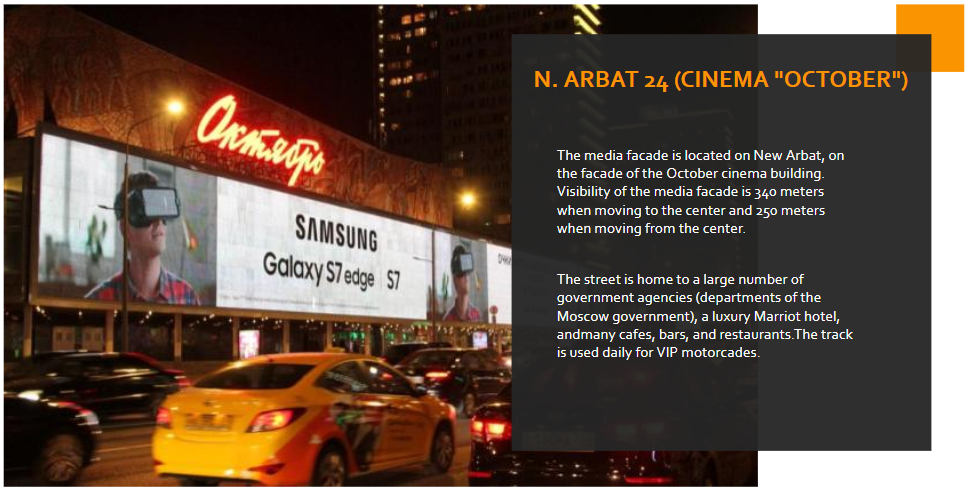

If we talk about the coverage of DOOH in numbers, the leaders in the number of digital screens are Moscow (885 surfaces) and St. Petersburg (495 surfaces). The total number of DOOH advertising platforms in regions is 1,164 media. What is more, the largest part of them are located in Nizhny Novgorod (299), Yekaterinburg (207) and Novosibirsk (147).

Basically, Russian operators offer 5 types of screens for placement, the most common of which is a 3*6 sq m digital billboard (DBB: 75% St. Petersburg, 72% Moscow, 62% regions). In second place were digital super sites 15*5/12*3/12*4 sq m (digital super site: 24% St. Petersburg, 19% Moscow, 16% regions). Other formats, digital city board (2.7 *3.7 sq m) and digital city format (1.2* 1.8 sq m), which have the technical capabilities to display video content, are only partially present in Moscow and the regions and are less in demand, while in St. Petersburg they are not available.

According to Gallery estimates the share of DOOH-programmatics in Russia already accounted for about 10% of the revenue of digital outdoor advertising in 2021. Moreover, advertisers, who considered outdoor advertising less than technological in the past, began to look closely at this format. However, this is far from the case now.

DOOH innovations have expanded the possibilities of placing advertisements. In particular, AR, VR, Mixed Reality, gesture motion sensors, Beacon/RFID, mobile retargeting for hypertargeting to pDOOH, IoT, cloud computing and real-time channel integration on digital screens. All these technologies have made it possible to improve the user experience of interacting with outdoor advertising in real time. In 2022, beacons were added to these tools, which allow you to send a signal from an advertising screen via Bluetooth to nearby smartphones. Thanks to this, advertisers can connect to users' phone in order to send them an informational, contextual or personalized experience. Eventually, beacons have increasingly become profitable means for news agencies, shopping malls and transportation services.

In other words, whatever a digital tool is used for a particular advertising screen, its advantages remain indisputable. In any format, DOOH provides advertisers with key data on consumer behavior that can and should be taken into account in further marketing communication in order to improve it. We are talking about data such as ad playback time, location of DOOH installations, total costs, etc.

All these technologies are also actively used on the Russian market, but with a single caveat. On the one hand, DOOH accounts for about 40% of revenue in the segment (the same indicator in the USA). At the same time, the share of digital inventory on the market is only 19%. Its volume has been growing in recent years, according to experts, but not at such a rapid pace. Probably, by the end of 2022, this figure will be considerably higher, since not only in advertisers, who purchased traditional OOH media in the past, are interested in the DOOH format, but also new digital players.

ACAR analysts managed to find out the level of digital technology coverage on the market in 2022. According to the poll, RTB is provided by 55% of regional outdoor advertising operators, 46% use guaranteed sales (guaranteed number of impressions) or OST (frequency of audience contacts with advertising) at a fixed price for a certain time period. Another 46% provide API integrations in which the client plans to place on the operator's advertising surfaces. Among Moscow advertisers of outdoor advertising, only 25% use auction sales, 29% guarantee a fixed number of impressions, while API is 33%. At the same time, the most common technology for collecting and analyzing data turned out to be a Wi-Fi audience tracking system for collecting unique MAC addresses of users. 47% of operators in Moscow, 29% in St. Petersburg and 24% in the regions are ready to provide this option.

In addition, other technologies are available to OOH customers. These include: launching videos by triggers, live broadcasts, setting up targeting and retargeting in real time by interests and socio-demographic characteristics, 3D advertising, dynamic creative management and synchronization of advertising impressions with multiple facades. Plus, operators are ready to provide data on the effectiveness of DOOH due to brand and sales lift, independent pixel meters (Weborama, Sizmek, Adriver) and monitoring of AdMetrix and Mediascope advertising output.

If we talk about the coverage of DOOH in numbers, the leaders in the number of digital screens are Moscow (885 surfaces) and St. Petersburg (495 surfaces). The total number of DOOH advertising platforms in regions is 1,164 media. What is more, the largest part of them are located in Nizhny Novgorod (299), Yekaterinburg (207) and Novosibirsk (147).

Basically, Russian operators offer 5 types of screens for placement, the most common of which is a 3*6 sq m digital billboard (DBB: 75% St. Petersburg, 72% Moscow, 62% regions). In second place were digital super sites 15*5/12*3/12*4 sq m (digital super site: 24% St. Petersburg, 19% Moscow, 16% regions). Other formats, digital city board (2.7 *3.7 sq m) and digital city format (1.2* 1.8 sq m), which have the technical capabilities to display video content, are only partially present in Moscow and the regions and are less in demand, while in St. Petersburg they are not available.

However, based on these data, it can be said that the DOOH inventory and the technologies that Russian operators currently provide to advertisers allow you to launch a campaign on outdoor digital media not only in Moscow, but also in the regions with all the necessary analytical functions.

“The digital advertising market has transformed with the exit of foreign advertising platforms. It is difficult to immediately fulfill the occurred unsatisfied demand with remaining Internet platforms. At the same time, digital outdoor advertising with its modern tools for purchasing inventory and managing campaigns has become even more attractive for advertisers who mainly used Internet promotion channels.” - Boris Peshnyak, Commercial Director of Rus Outdoor (- comment for the portal Sostav.ru ).

“The digital advertising market has transformed with the exit of foreign advertising platforms. It is difficult to immediately fulfill the occurred unsatisfied demand with remaining Internet platforms. At the same time, digital outdoor advertising with its modern tools for purchasing inventory and managing campaigns has become even more attractive for advertisers who mainly used Internet promotion channels.” - Boris Peshnyak, Commercial Director of Rus Outdoor (- comment for the portal Sostav.ru ).

Promising DOOH Trends for the Near Future

Thanks to various digital outdoor advertising technologies, experts anticipate that in the near future DOOH will develop according to the following indicators.

Firstly, the measurability of the digital format of outdoor advertising will increase more and more. Because this tool allows you to assess the extent of the campaign coverage as a whole. In the case of DOOH, this can be implemented through various indicators of assessment of the effectiveness of digital screens. For example, by launching the DOOH programmer through myTarget, you can estimate the “profitability” to offline sales points, conversions on the website and in the mobile application. Ultimately, in the future, DOOH will not only demonstrate the growth of awareness of the advertised brand, but also measure the middle and lower indicators of the funnel, conversions and sales.

Secondly, many experts agree that advertising at airports will have new formats and opportunities. As the volume of air traffic gradually returns to the pre-pandemic high level, the demand for OOH is also growing. Most likely, outdoor advertising at airports will also be digitized in order to improve the interaction between the object of advertising and the audience.

Thirdly, it is impossible not to take into account the increasing integration of Internet TV (OTT) in DOOH, which allows advertisers to expand video strategies by reaching the audience of services. Besides, the digital format of outdoor advertising in this case allows marketers to place creative content and UGC through social media of their brand. And geometrics in smartphone apps next to DOOH allows to create an omnichannel experience with targeted advertising and redirecting potential customers to the nearest points of sale of the company.

That is, all of the above trends can be characterized by the following conclusion. The more investments are integrated into the placement of digital outdoor advertising, the more effective it becomes. This brings DOOH to a potentially new, more strategic and technological level of marketing activity. Including the Russian market, as evidenced by the indicators of budget growth in this segment.

Firstly, the measurability of the digital format of outdoor advertising will increase more and more. Because this tool allows you to assess the extent of the campaign coverage as a whole. In the case of DOOH, this can be implemented through various indicators of assessment of the effectiveness of digital screens. For example, by launching the DOOH programmer through myTarget, you can estimate the “profitability” to offline sales points, conversions on the website and in the mobile application. Ultimately, in the future, DOOH will not only demonstrate the growth of awareness of the advertised brand, but also measure the middle and lower indicators of the funnel, conversions and sales.

Secondly, many experts agree that advertising at airports will have new formats and opportunities. As the volume of air traffic gradually returns to the pre-pandemic high level, the demand for OOH is also growing. Most likely, outdoor advertising at airports will also be digitized in order to improve the interaction between the object of advertising and the audience.

Thirdly, it is impossible not to take into account the increasing integration of Internet TV (OTT) in DOOH, which allows advertisers to expand video strategies by reaching the audience of services. Besides, the digital format of outdoor advertising in this case allows marketers to place creative content and UGC through social media of their brand. And geometrics in smartphone apps next to DOOH allows to create an omnichannel experience with targeted advertising and redirecting potential customers to the nearest points of sale of the company.

That is, all of the above trends can be characterized by the following conclusion. The more investments are integrated into the placement of digital outdoor advertising, the more effective it becomes. This brings DOOH to a potentially new, more strategic and technological level of marketing activity. Including the Russian market, as evidenced by the indicators of budget growth in this segment.

Audience Opinion

In addition to the technological advantages of DOOH, its effectiveness in 2022 can also be characterized by a positive attitude on the part of consumers. Kantar Group experts found out that the digital format of outdoor advertising encourages them to interact with advertising messages, as well as to make purchases. A considerable part of the respondents rated such advertising as the most innovative, relevant, memorable and stimulating to action.

The study involved 11 thousand respondents from different countries of the world who rated DOOH according to 14 unique perception criteria. The survey also highlighted the fact that digital outdoor advertising in some criteria surpasses other popular advertising channels in its perception.

"Consumers like DOOH advertising, they trust it and interact with it, and also believe that it improves their environment and often give more favorable assessments to digital outdoor advertising than marketers," the authors of the project say in conclusion.

The study involved 11 thousand respondents from different countries of the world who rated DOOH according to 14 unique perception criteria. The survey also highlighted the fact that digital outdoor advertising in some criteria surpasses other popular advertising channels in its perception.

"Consumers like DOOH advertising, they trust it and interact with it, and also believe that it improves their environment and often give more favorable assessments to digital outdoor advertising than marketers," the authors of the project say in conclusion.

In Conclusion

Despite the instability of the market during the period of sanctions policy towards Russia, the segment of OOH advertising still remains at a stable level of its indicators. Although many experts at the beginning of 2022 predicted a lower income than it is now. This is largely due to the fact that the share of departed companies in OHH is about 14-15%. Plus, advertisers are increasingly becoming interested in the digital format of outdoor advertising.

In turn, the choice in favor of DOOH and its technical capabilities requires a high level of expertise. But the result fully justifies all the necessary efforts, as we can see from various analytical data for 2022.

Entrust this task to RMAA specialists who are ready to find the most effective platforms for posting a DOOH campaign, taking into account all the features of the Russian market and the expectations of the target audience of your product.

In turn, the choice in favor of DOOH and its technical capabilities requires a high level of expertise. But the result fully justifies all the necessary efforts, as we can see from various analytical data for 2022.

Entrust this task to RMAA specialists who are ready to find the most effective platforms for posting a DOOH campaign, taking into account all the features of the Russian market and the expectations of the target audience of your product.

Natali Gorenkova

In her role as a content marketing coordinator, Natali creates a wide range of engaging and useful content for 1235marketing, from blog articles to extensive White Papers. She excels at navigating emerging markets and filling the blog with useful and up-to-date information for our clients.

Follow us in social media

Get the White Paper

Possible Prospects For New Brands

Russian Market Under The Influence Of Western Sanctions

Ready to make a shift?

Give us all details about the amazing project in your mind and our professionals will get back to you with cool ideas in a short time

24000 Korzo 1, Floor 2, Apartment 18-19, Subotica, Serbia, Autonomous Province of Vojvodina

Serbia,Subotica

121099, Vozdvizhenka st. , building 10

Moscow, Russia

Moscow, Russia

Russia, Moscow

Av. Córdoba 1351 Piso 3 y 5, C1055 CABA, Buenos Aires, Argentina

Argentina, Buenos Aires

06620 13F, Daegak Bldg.,

5 Seocho-daero 78-gil,

Seocho-gu, Seoul, Korea

5 Seocho-daero 78-gil,

Seocho-gu, Seoul, Korea

South Korea, Seoul

our partners